florida estate tax rates 2021

The tax is usually assessed progressively. This means that the tax rate.

Tampa Bay Counties Are Setting Their Property Tax Rates Here S What That Means For You Wusf Public Media

The average Florida homeowner pays 1752.

. The 2022 state personal income tax brackets. The Florida corporate incomefranchise tax rate is reduced from 55 to 4458 for taxable years beginning on or after January 1 2019 but before January 1 2022. Martin County collects on average 091 of a propertys.

Hillsborough County collects on average 109 of a propertys. Floridas general state sales tax rate is 6 with the following exceptions. This data is based on a 5-year study of median property tax rates.

Florida estate tax rates 2021 Saturday March 12 2022 Edit. Florida has a sales tax rate of 6 percent. The median property tax in St.

Floating Rate of Interest Remains at 7 Percent for the Period January 1 2022 Through June 30 2022. Property taxes can vary greatly depending on the state that you live in. The top estate tax rate is 12 percent and is capped at 15 million exemption threshold.

Sales tax is added to the price of taxable goods or services and collected from the purchaser at the time of sale. Florida estate planning lawyers help people develop a family or business-friendly strategy to maximize tax savings tax cuts. The current federal tax exemptions are at 117 million in 2021.

Click the nifty map below to find the current rates. Lucie County collects on average 124 of a propertys. There is also an average of 105 percent local tax added onto transactions giving the state its 705.

So we took a closer look into property taxes by state to give you a comparative look. Before the official 2022 Florida income tax rates are released provisional 2022 tax rates are based on Floridas 2021 income tax brackets. The median property tax in Hillsborough County Florida is 2168 per year for a home worth the median value of 198900.

Lucie County Florida is 2198 per year for a home worth the median value of 177200. Since Floridas estate tax was based solely on the federal credit estate tax was no longer due on estates of decedents that died on or after January 1 2005. The median property tax in Martin County Florida is 2315 per year for a home worth the median value of 254900.

Inheritance tax is calculated based on a tax rate applied to the amount that exceeds an exemption amount.

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

What Is The Death Tax And How Does It Work Smartasset

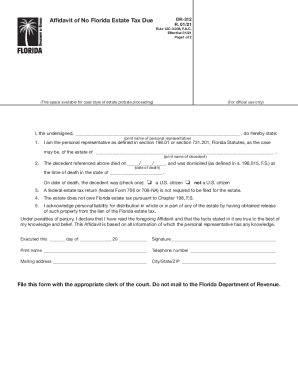

Dr 312 Fill Out And Sign Printable Pdf Template Signnow

The Biden Administration And Florida Estate Planning Estate Planning Attorney Gibbs Law Fort Myers Fl

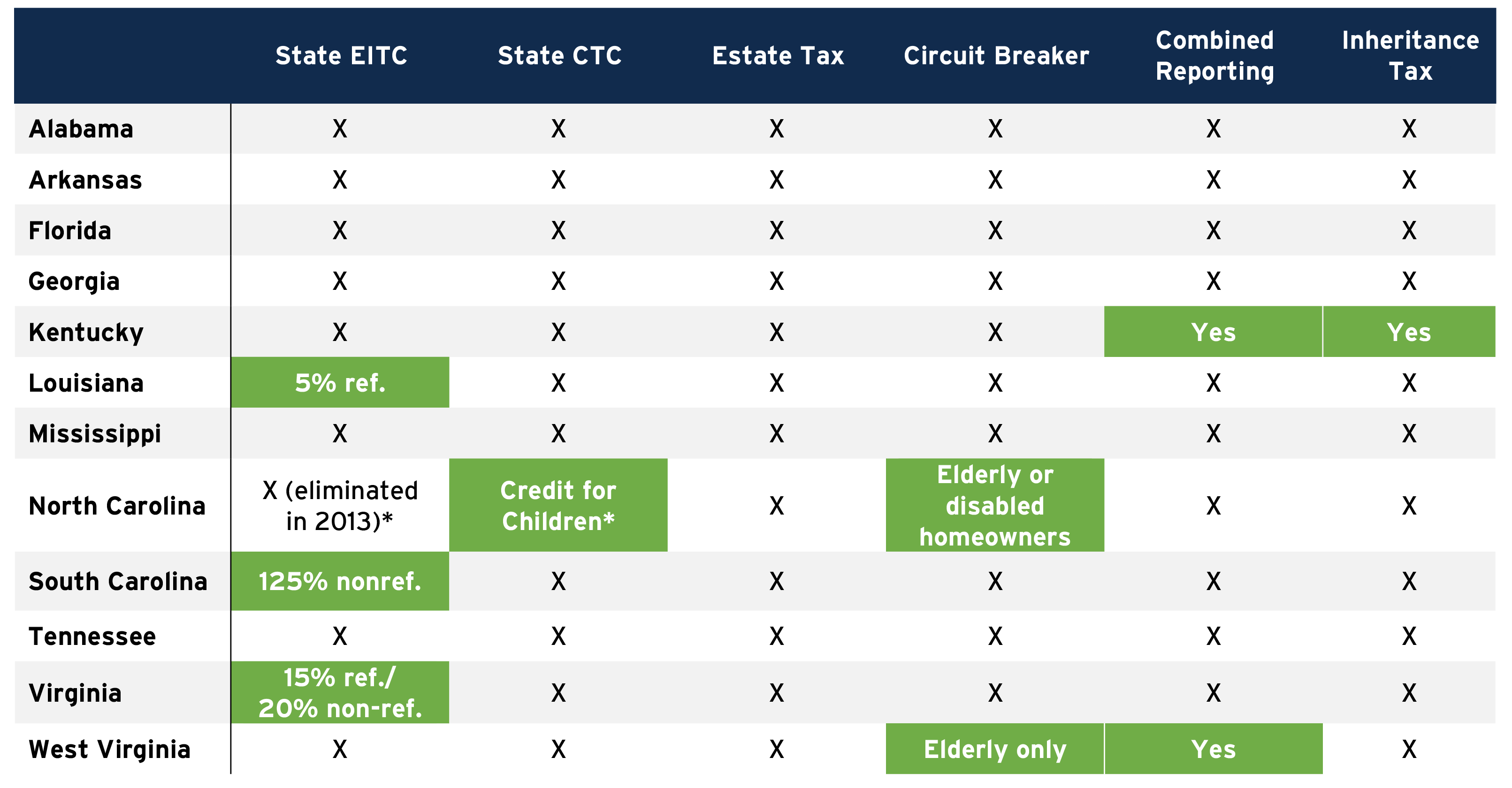

Creating Racially And Economically Equitable Tax Policy In The South Itep

How Racial And Ethnic Biases Are Baked Into The U S Tax System

Individual Income Taxes Urban Institute

State Income Tax Rates And Brackets 2021 Tax Foundation

Estate And Inheritance Taxes By State In 2021 The Motley Fool

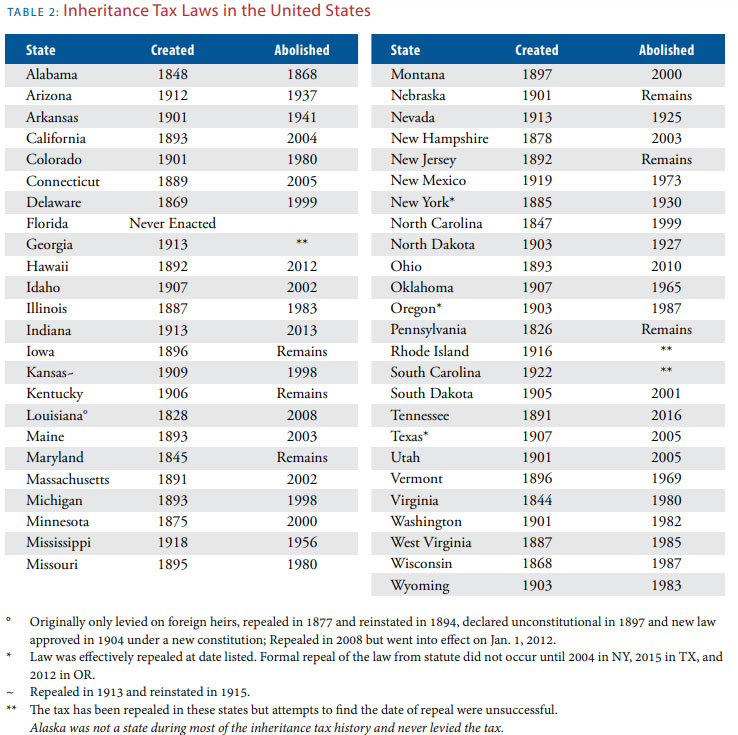

Death And Taxes Nebraska S Inheritance Tax

:max_bytes(150000):strip_icc()/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-02-822f6b88f3fe437caed0b5ca5bc51bdf.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

Does Florida Have An Inheritance Tax Alper Law

Florida Real Estate Taxes What You Need To Know

New York Estate Tax Everything You Need To Know Smartasset

Florida Estate Tax Everything You Need To Know Smartasset

/estate_taxes_who_pays_what_and_how_much-5bfc342146e0fb00265d85b5.jpg)

Estate Taxes Who Pays And How Much

18 States With Scary Death Taxes Kiplinger

State Tax Levels In The United States Wikipedia

Ranking Property Taxes By State Property Tax Ranking Tax Foundation